Air France Pilots’ strike action from 15 to 22 September 2014

Air France Pilots’ strike action from 15 to 22 September 2014

Due to the call for strike action by several pilot unions, from September 15 to 22, Air France expect important disruptions in their flights schedule as of Monday, September 15, 2014.

Please note that Air France flights operated by other airlines, including HOP, KLM and Delta, are not affected by this strike.

The application of the Diard law will allow Air France to have a more accurate estimation of the number of pilots declaring themselves on strike action 48 hours in advance.

Air France’s flight schedule will be adapted accordingly and published at latest 24 hours ahead of departure. If you have left the airline your personal contact, they will be able to advise you by SMS or Email.

On September 15th and 16th, our flight schedule is updated.

– Last minute disturbances are not excluded.

– Before you go to the airport, it is recommended to verify the informations on operated flights. Air France’s flight schedule is updated 24h before the departure, in the “Flight schedules” section and on their mobile sites.

Air France’s teams are fully mobilized and make their utmost to assist you and minimize the impact of this industrial action on your travel plans.

If you are travelling on a flight operated by Air France, we propose you to modify your departure to avoid the period from September 15th to 22nd 2014, with the following conditions:

– You may postpone your trip between September 23rd and 30th, 2014 included, at no extra cost in the same cabin, on this website, in the “Review / modify your reservations” section, on our mobile sites or from your travel agent.

– To postpone your trip beyond September 30th, 2014, to change your origin or destination or if you no longer wish to travel, you can benefit of non-refundable voucher valid one year on Air France or KLM. In this case, please contact your usual travel agent.

– If your flight is cancelled or delayed by more than 5 hours, you can also request the refund of your ticket. For this option, we invite you to visit our “Practical information” page below, or contact your usual travel agency.

Practical information:

To allow Air France to inform you personally in real time of any changes on your flight, please check that you have updated your personal contact details (mobile telephone and/or email address) in your reservation file or your Flying Blue profile.

You can consult and update this information at any time on Air France’s website in the “Consult/modify my bookings” section and on our mobile sites.

Before you go to the airport, it is recommended to verify the informations on operated flights. Air France’s flight schedule is updated 24h before the departure, in the “Flight schedules” section and on our mobile sites.

Delta Air Lines: Targeting Operational Efficiency (DAL)

Delta Air Lines: Targeting Operational Efficiency (DAL)

Delta Air Lines’ (NYSE:DAL) stock produced an outstanding return in one year. If we look at the return produced by Delta Air Lines compared to the SP 500 and two other airlines, Ryan Air Holdings (RYA. L) and Easy Jet (EZJ.L), we see that DAL outperformed by a great margin. DAL produced an outstanding return of 107.16% while the SP 500produceda significantly lower return of 20%. The shares of Ryan Air Holdings and Easy Jet produced poor returns that were near to zero. This outstanding return is a reflection of DAL’s zeal towards bringing efficiency in all aspects of its business.

The Huge Global Network is Positioned for Long-Term Growth

Each year DAL serves about 165 million customers worldwide. Air Transport World magazine named DAL the “2014 Airline of the Year”. It also won a place in Fortune magazine’s “50 Most Admired Companies” list. Through its 700 aircraft main fleet and nearly 80,000 employees, DAL offers superior services to about 333 destinations, in 64 countries, in all 6 habitable continents. This huge global presence allows DAL to capitalize on the healthy growth in air travel that is forecasted by economists. Economists forecast the emerging markets will lead the growth in the coming years.

Long Term Sustained Growth in Focus

Delta Air Lines brought the same momentum from 2013’s excellent financial performance to 2014. DAL is expected to grow its bottom line and free cash flow and to expand its profit margins. DAL has enacted a number of initiatives to maintain the momentum of excellent financial performance in both the medium and long terms. DAL is working to strengthen its balance sheet by reducing the debt and funding the pension.

Outperforming The Airline Industry

The airline industry is becoming increasingly competitive. In an effort to survive airline companies are evolving the way they operate. DAL is the leader of the pack that is very proactive in bringing efficiency to its business in order to produce excellent financial performance. In the first quarter of 2014 the company outperformed the industry with a record high pretax profit. Its secured the highest customer satisfaction score among network carriers.

Strong Operational and Financial Performance in the 2ndQuarter of 2014

On the operational side DAL continues to deliver reliable services by satisfying its customers. DAL managed to increase traffic by 5% during the quarter compared to the figure reported last year. DAL also achieved a 3.2% increase in capacity during the same period. DAL improved its worldwide network by connecting the DAL hub in New York and Seattle to London-Heathrow, Rome Zurich, Seoul and Hong Kong. These are crucial business destinations and with its improved service DAL will be able to benefit from these key routes. Following the domestic fleet restructuring, which is aiming at replacing less-efficient domestic aircrafts, DAL ordered 15 A321 aircrafts.

On the financial side, DAL managed to attain 9% topline growth earning an additional $914 million compared to the revenue DAL produced during the same quarter last year. DAL also managed to expand its operating margin to 14.9% reflecting an increase of 4% compared to last year’s figure.

DAL is working on an aggressive plan to improve all aspects of its operations that will result in a reduction in costs and an increase in income. Its pre-tax income for the quarter reached $1.4 billion with an increase of $593 million compared to the pre-tax income level of same quarter last year reflecting a 73% increase in pre-tax income. DAL managed to generate over $2 billion of operating cash flow and about $1.5 billion free cash flow in the 2nd quarter of 2014.DAL shares its success with its shareholders. In the second quarter of the current year DAL rewarded shareholders with $550 million through share repurchases and dividend payments.

Aiming at an Optimal Capital Structure to Improve Valuation

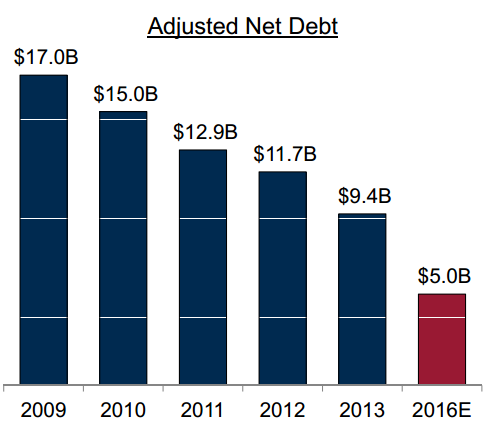

DAL is working on a multi-year plan to change its capital structure in order to attain optimum capital structure. DAL has been consistently reducing its debt through strong cash generation. Reducing the debt is creating value for shareholders since reducing debt is resulting in reduced funding costs and earnings are improving thanks to the lower interest expense. This strategy is reducing the risk and DLA’s cost of capital resulting in improved valuation. Following this long-term plan for debt reduction, DAL used its 2nd quarter cash flow to reduce its net debt to below $8 billion. DAL is targeting at a debt level of $5 billion by 2016.

Strong Financial Performance Expected for DAL’s Third Quarter

DAL expects the September quarter to produce even better financial results. DAL expects that its initiatives will result in increased operational efficiency and translate into an expanded operating margin. The operating margin is expected to increase to 15-17% and that would contribute to growth in the bottom line. DAL is targeting system capacity expansion of 2-3% compared to the figure reported in the same quarter last year.

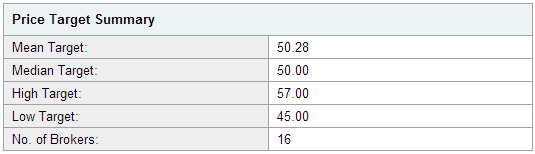

The Target Price Estimate Makes DAL a Must-Own Stock

Target price estimates polled by Thomson/First Call from 16 brokers covering DAL show attractive upside at the current price. The mean target price is $50.28 and presents an upward potential of 24% at the current price level of about $40.52.The median target price is $50 and presents an upward potential of 23% at the current price level. The most optimistic price estimate is $57and if materialized it presents an upside of 40%. The lowest target price estimate is $45 and presents an 11% upside. This is a very enticing valuation estimate where even the most pessimistic estimate presents an attractive upside at the current price. DAL’s stock is a must own for investors that are interested in gaining exposure in the growing airline industry.

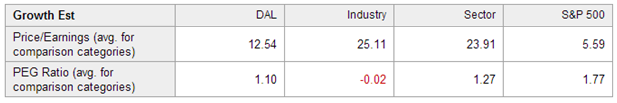

Relative Valuation Supports The Target Price Estimate

DAL’s P/E ratio stands at an attractive level of 12.54 times (shown in the figure below). The P/E ratio shows that the company is undervalued compared to the industry and the sector but overvalued compared to the average comparison category of the SP 500. Adding expected growth to the P/E analysis, the PEG ratio of 1.10 shows that DAL is undervalued compared to the comparison category of the sector and the SP 500. The price multiples reveal that DAL’s stock is relatively undervalued at its current price level and presents itself as a very attractive investment opportunity.

Conclusion

Delta is well positioned to capitalize on the growth in the air travel forecasted by economists. Emerging markets are expected to lead the growth and DAL’s global presence is expected to help it capitalize on the growth. DAL is aggressively working to bring operational efficiency to all aspects of its operations and this effort is translating into excellent financial performance. The consensus target price and relative valuation reveal that DAL is underappreciated by the market and presents itself as a very attractive upside at its current price.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.

UPDATE 1-Emirates executive says airline is not interested in Qantas investment

UPDATE 1-Emirates executive says airline is not interested in Qantas investment

* Emirates invests in planes, not shares, says CCO

* Would order more A380s if Airbus revamps plane, he says

* Says has redeployed planes after route suspensions

(Adds comments on flight suspensions, A380 revamp)

FRANKFURT, Sept 1 (Reuters) – Airline Emirates is not interested in investing in the international operations of Qantas, the Dubai-based carrier’s chief commercial officer (CCO) said on Monday.

In the biggest restructuring step since Qantas was privatised two decades ago, the airline is hiving off its international arm from its domestic business.

The move will allow a foreign airline to take as much as a 49 percent stake – a major change from the previous 35 percent limit – and analysts had suggested that alliance partner Emirates could be interested.

But Emirates’ CCO Thierry Antinori said that doesn’t fit with the airline’s strategy.

“We buy planes and invest in products; we do not buy shares,” he told Reuters in an interview during an event in Frankfurt to celebrate the airline putting an A380 jumbo jet on the Dubai-Frankfurt route.

Under its partnership with Qantas, through which the companies share some revenue, Qantas has moved its European operations base from Singapore to Dubai and Emirates is letting Qantas share its new terminal, which was for the exclusive use of its Airbus A380.

Emirates, though, has shied away from traditional airlines alliances One World, Star Alliance and Sky Team, saying it prefers to go it alone.

The rapid expansion of Gulf carriers such as Emirates, Qatar and Etihad has posed a particular problem for European legacy airlines. Lufthansa and Air France are both planning to expand their low-cost units to respond to competition from Gulf airlines and budget rivals.

Antinori, a former Lufthansa manager, said this kind of thinking was the wrong path to take.

“If you, as an airline, and there are unfortunately a lot of examples of this in Europe, begin to calibrate your strategy as ‘what can I do against this airline or this airline’, you will fail,” he said.

SECURITY RISKS

Antinori also said that recent suspensions of routes to places such as Arbil, Syria and Tripoli because of fighting in those countries were not good news for Emirates but that the company had been able to redeploy planes on routes such as to Casablanca and Budapest. Emirates has also suspended flights to Guinea because of the Ebola virus.

“It’s not good news, but we are able to redeploy the aircraft and to limit the damage,” he said of the suspensions. In particular, the suspension of flights to Arbil, northern Iraq, is damaging to its cargo operations, Antinori said.

Load factors are still running above last year’s levels, he said when asked whether the route changes were having an impact on how full its planes were.

He also confirmed that Emirates is still interested in ordering more A380s from Airbus if the plane maker revamps the jumbo jet with new engines, and that the airline is in continuous discussions with Airbus.

Emirates is the world’s biggest operator of the A380, with 51 in service and another 89 on order, but Antinori said further orders would have to be for the more fuel-efficient neo version of the aircraft.

He also said Emirates will remain patient as it waits for Germany to rework the air traffic agreement that allows Emirates to fly to only to four airports in the country.

The airline is keen to fly to Berlin and Stuttgart but says it does not want to give up its services to Hamburg, Frankfurt, Munich and Duesseldorf. It had previously lobbied hard for the right to fly to more airports.

“One day it will come,” Antinori said.

(Reporting by Victoria Bryan and Peter Maushagen; Editing by

Harro ten Wolde and David Goodman)

Hertz gives itself a technology upgrade – Tnooz

Hertz gives itself a technology upgrade – Tnooz

http://www.tnooz.com/article/car-rental-giant-hertz-gives-technological-upgrade/

Boeing, Airbus Battle for Delta Order

Boeing, Airbus Battle for Delta Order

When there are only two companies that make a very expensive product, any time there’s a chance to take a big order, well, it is a very big deal. Delta Air Lines Co. (NYSE: DAL) has given Boeing Co. (NYSE: BA) and Paris-traded Airbus Group just such a chance.

The airline sent both airplane makers a request for proposal for up to 50 wide-body (dual-aisle) jets to replace some of the oldest planes in Delta’s fleet. The company is particularly interested in replacing its 16 four-engine 747s and replacing them with the new twin-engine wide-bodies, Boeing’s 777 and 787 and Airbus’s A330 and A350 models. Delta has also said that it wants to sell some of its twin-engine Boeing 767-300ERs.

Delta has said that it is not interested in buying planes that are still in development, which would appear to exclude Boeing’s 777X series and the longer range A330s currently under development at Airbus. Delta already has an order in with Boeing for 18 787 Dreamliners. The order was placed by Northwest Airlines before its 2008 merger with Delta.

The list price for a Boeing 777-300ER is $320.2 million and the comparable Airbus A330-300 costs $245.6 million. Boeing’s 787-9 lists for $249.5 million and the Airbus A350-900 lists for $295.2 million. At those prices, if Delta decided to buy 50 of the 777-300ERs, the tab would be just over $16 billion. For 50 of the Airbus A330-300s, Delta would pay about $12.3 billion.

Because Delta and the other airlines never pay list prices, the airlines can expect a discount of 25% to 30%, and if Delta were to go with just one aircraft maker the discount could be as much as 60%. At a standard discount of 25%, the A330-300 might cost $184 million, compared with $240 million for a Boeing 777-300ER. How far could/would Boeing lower its price to win the business? The 777-300ER is one of Boeing’s highest priced planes and one of its best sellers.

In addition, Boeing and Airbus are also battling for a contract to supply South Korea with military refueling tankers.

Boeing shares closed at $128.78 Thursday night and were inactive in premarket trading Friday. The stock’s 52-week range is $83.91 to $144.57.

Delta Air Lines plans to hire 1800 flight attendants

Delta Air Lines plans to hire 1800 flight attendants

Cabin in a PBair Embraer ERJ 145 LR featuring an air hostess and a steward serving passengers in the air (Photo credit: Wikipedia)

Atlanta-based Delta Air Lines says it plans to hire at least 1,800 flight attendants as it plans for growth next year.

The airline has already begun taking applications for the positions with interviews set to begin in the fall.

The first flight attendants will enter training in January. Officials say the company received more than 100,000 applications during a previous round of hiring for flight attendants.

Delta reported an $801 million profit in the second quarter, up 17 percent from a year earlier. The company is projecting that its flight schedule will grow 2 to 3 percent in the third quarter compared to a year earlier.

5 things Delta’s management wants you to know

5 things Delta’s management wants you to know

Delta Air Lines, (DAL) has led the airline industry in a remarkable renaissance in the last 2 years or so. Delta stock has more than quadrupled, thanks to rapid margin expansion and increasing investor confidence.

In Q2, Delta once again reported record quarterly earnings. On the company’s earnings call last month, Delta’s management team talked about global demand trends and their strategic initiatives going forward. Here are 5 key points that Delta executives wanted to emphasize for investors.

The new Seattle hub is working

“Part of our Pacific restructuring is building out the Seattle gateway. Our Seattle international franchise is doing well… The domestic unit in Seattle also continues to perform well, producing unit revenue improvement in line with our system averages.” — Delta Air Lines President Ed Bastian

Delta has been rapidly growing in Seattle recently. The airline is looking to build up a solid international gateway in Seattle while reducing its reliance on market-leader Alaska Airlines for connecting traffic.

In the last few months, Delta has added daily nonstop service from Seattle to London, Seoul, and Hong Kong. It is supporting this expansion with new short-haul flights to almost every major city on (or near) the West Coast.

So far, this growth seems to be working. Delta’s unit revenue in Seattle rose last quarter despite all of its capacity growth. As its new routes mature in the next couple of years, Delta’s profitability in Seattle should continue to rise.

Moving to larger jets is boosting margins

“This up-gauging is producing meaningful operating leverage. For the June quarter, we produced 3% higher domestic capacity on almost 4% fewer departures.” — Delta Air Lines CFO Paul Jacobson

A major facet of Delta’s profit improvement plan is its domestic fleet restructuring. In 2012, Delta announced plans to reduce unit costs by retiring most of its 50-seat regional jets by the end of 2015. These are being replaced by a combination of small mainline aircraft (110-seat Boeing 717s) and large regional jets (76 seat CRJ900s).

Delta Air Lines is saving money by replacing inefficient 50-seat jets with larger planes (Photo: The Motley Fool)

These larger planes are significantly more fuel-efficient, and Delta can now carry more traffic with fewer planes. That saves on labor costs, airport costs, and maintenance costs. Delta expects to retire 47 small regional jets in the second half of 2014, and another 80-90 in 2015. Thus the savings from this fleet restructuring will continue to grow.

Delta’s joint venture with Virgin Atlantic is helping

“On the corporate volumes, clearly Virgin has been a big assist with respect to our being able to get a stronger foothold in the lucrative JFK-Heathrow marketplace, particularly with the financial services providers. And we continue to see very strong growth in New York.” — Delta Air Lines President Ed Bastian

In 2012, Delta made a strategic investment in struggling UK airline Virgin Atlantic. The two carriers have since formed a joint venture for flights between the U.S. and the U.K. This has dramatically boosted Delta’s presence at London-Heathrow — a key airport for international business travel.

The Delta-Virgin Atlantic joint venture is now No. 2 in market share on the popular New York-London route. This in turn is helping Delta win corporate contracts in New York, particularly in the financial sector. Delta’s management called out New York as one of the two hub markets that saw the biggest unit revenue growth last quarter.

Disciplined CapEx drives tangible benefits

“By maintaining capital discipline and keeping our CapEx at $2.3 billion this year, we should generate over $3 billion in free cash flow. We will use that free cash flow to further improve our balance sheet, and return more cash to shareholders.” — Delta Air Lines CEO Richard Anderson

Among the 3 big U.S. network carriers, Delta produces by far the most free cash flow. By contrast, United Continental and American Airlines are generating virtually no free cash flow. In United’s case, the problem is its comparatively low profitability; in American’s case, free cash flow is weighed down by the company’s massive CapEx budget.

Delta rival American Airlines is not generating much free cash flow

Delta’s strong free cash flow is allowing it to rapidly pay down debt. Since 2009, Delta has cut its adjusted net debt from more than $17 billion to less than $8 billion. Delta also introduced a dividend last year (currently $0.09 per quarter) and it plans to buy back $2 billion of stock by the end of 2016. Lastly, Delta is contributing $1 billion annually to its pension plan to reduce its pension liability.

Fuel hedging is here to stay

“We also believe in actively managing fuel… Graham Burnett has done a fine job running our fuel organization. This has allowed us to regularly produce quarter after quarter one of the lowest fuel prices in the industry.” — Delta Air Lines CEO Richard Anderson

Delta’s top rival, American Airlines, recently closed out the last of its fuel hedges. American’s management team is philosophically opposed to fuel hedging, believing that over time, fuel hedging is a money-losing strategy. However, Delta Air Lines remains committed to “actively managing” fuel prices.

In addition to maintaining traditional fuel hedges, Delta also owns a refinery in Pennsylvania. This allows it to hedge against changes in the “crack spread”: the price difference between crude oil and jet fuel. While the refinery is only marginally profitable today, Delta is protected from the risk of a surge in refining costs — something that occurred back in 2012.

Foolish wrap

Delta Air Lines is unique within the U.S. airline industry. Delta’s management team hasn’t been afraid to go against the industry consensus in recent years. Unusual aspects of Delta’s business plan include using older planes, shifting flying back to its mainline operations from regional airlines, and refining its own fuel.

Delta’s management remained unapologetic about its unconventional thinking on the recent Q2 conference call. As long as the company continues to post industry-leading profitability and free cash flow metrics, investors aren’t likely to complain.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

Russia’s Aeroflot defies sanctions to create new low-cost airline Dobrolyot

Russia’s Aeroflot defies sanctions to create new low-cost airline Dobrolyot

MOSCOW – Russian flag carrier Aeroflot will create a new low-cost unit after Western sanctions grounded its first effort to enter the market, the airline’s chief executive said on Sunday.

“We will after all register a new airline,” Aeroflot chief executive Vitaly Savelyev was quoted as saying by Russian news agencies.

He said the company’s low-cost carrier, Dobrolyot, had worked well during the six weeks it was allowed to operate.

Dobrolyot was forced to shut down because it flew to Russian-annexed Crimea and was therefore hit by EU sanctions imposed over the Kremlin’s alleged support for pro-Russian rebels in Ukraine, including the cancellation of the leasing contracts for its Boeing aircraft.

“We are holding talks with leasing companies and the first steps show that they want to work with us,” said Mr Savelyev.

He said possible routes were still being worked out, but that the new airline could begin operations from the end of October when the winter schedule begins.

Mr Savelyev said flights to Crimea, which Russia annexed from Ukraine in March, would depend on demand.

Services to the popular Black Sea summer resort are usually cut back during the winter months.

New fuel-efficient jets are key to the success of low-cost airlines as the high cost of fuel often makes it their biggest expense.

Leasing allows new airlines the opportunity to acquire aircraft more quickly without huge up-front investments.

Dobrolyot, which operated two Boeing 737-800 aircraft when it was forced to shut down, had planned to lease another six this year to begin flying to a handful of Russian cities.