Delta Air Lines: Targeting Operational Efficiency (DAL)

Delta Air Lines: Targeting Operational Efficiency (DAL)

Delta Air Lines’ (NYSE:DAL) stock produced an outstanding return in one year. If we look at the return produced by Delta Air Lines compared to the SP 500 and two other airlines, Ryan Air Holdings (RYA. L) and Easy Jet (EZJ.L), we see that DAL outperformed by a great margin. DAL produced an outstanding return of 107.16% while the SP 500produceda significantly lower return of 20%. The shares of Ryan Air Holdings and Easy Jet produced poor returns that were near to zero. This outstanding return is a reflection of DAL’s zeal towards bringing efficiency in all aspects of its business.

The Huge Global Network is Positioned for Long-Term Growth

Each year DAL serves about 165 million customers worldwide. Air Transport World magazine named DAL the “2014 Airline of the Year”. It also won a place in Fortune magazine’s “50 Most Admired Companies” list. Through its 700 aircraft main fleet and nearly 80,000 employees, DAL offers superior services to about 333 destinations, in 64 countries, in all 6 habitable continents. This huge global presence allows DAL to capitalize on the healthy growth in air travel that is forecasted by economists. Economists forecast the emerging markets will lead the growth in the coming years.

Long Term Sustained Growth in Focus

Delta Air Lines brought the same momentum from 2013’s excellent financial performance to 2014. DAL is expected to grow its bottom line and free cash flow and to expand its profit margins. DAL has enacted a number of initiatives to maintain the momentum of excellent financial performance in both the medium and long terms. DAL is working to strengthen its balance sheet by reducing the debt and funding the pension.

Outperforming The Airline Industry

The airline industry is becoming increasingly competitive. In an effort to survive airline companies are evolving the way they operate. DAL is the leader of the pack that is very proactive in bringing efficiency to its business in order to produce excellent financial performance. In the first quarter of 2014 the company outperformed the industry with a record high pretax profit. Its secured the highest customer satisfaction score among network carriers.

Strong Operational and Financial Performance in the 2ndQuarter of 2014

On the operational side DAL continues to deliver reliable services by satisfying its customers. DAL managed to increase traffic by 5% during the quarter compared to the figure reported last year. DAL also achieved a 3.2% increase in capacity during the same period. DAL improved its worldwide network by connecting the DAL hub in New York and Seattle to London-Heathrow, Rome Zurich, Seoul and Hong Kong. These are crucial business destinations and with its improved service DAL will be able to benefit from these key routes. Following the domestic fleet restructuring, which is aiming at replacing less-efficient domestic aircrafts, DAL ordered 15 A321 aircrafts.

On the financial side, DAL managed to attain 9% topline growth earning an additional $914 million compared to the revenue DAL produced during the same quarter last year. DAL also managed to expand its operating margin to 14.9% reflecting an increase of 4% compared to last year’s figure.

DAL is working on an aggressive plan to improve all aspects of its operations that will result in a reduction in costs and an increase in income. Its pre-tax income for the quarter reached $1.4 billion with an increase of $593 million compared to the pre-tax income level of same quarter last year reflecting a 73% increase in pre-tax income. DAL managed to generate over $2 billion of operating cash flow and about $1.5 billion free cash flow in the 2nd quarter of 2014.DAL shares its success with its shareholders. In the second quarter of the current year DAL rewarded shareholders with $550 million through share repurchases and dividend payments.

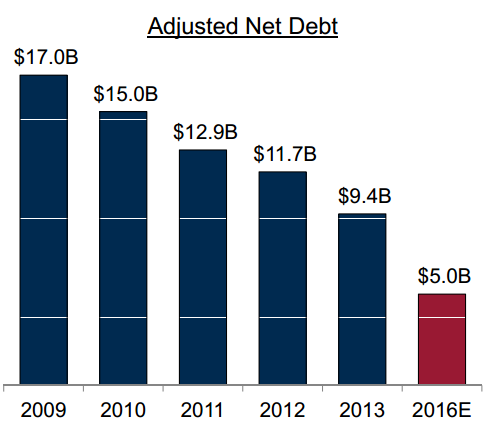

Aiming at an Optimal Capital Structure to Improve Valuation

DAL is working on a multi-year plan to change its capital structure in order to attain optimum capital structure. DAL has been consistently reducing its debt through strong cash generation. Reducing the debt is creating value for shareholders since reducing debt is resulting in reduced funding costs and earnings are improving thanks to the lower interest expense. This strategy is reducing the risk and DLA’s cost of capital resulting in improved valuation. Following this long-term plan for debt reduction, DAL used its 2nd quarter cash flow to reduce its net debt to below $8 billion. DAL is targeting at a debt level of $5 billion by 2016.

Strong Financial Performance Expected for DAL’s Third Quarter

DAL expects the September quarter to produce even better financial results. DAL expects that its initiatives will result in increased operational efficiency and translate into an expanded operating margin. The operating margin is expected to increase to 15-17% and that would contribute to growth in the bottom line. DAL is targeting system capacity expansion of 2-3% compared to the figure reported in the same quarter last year.

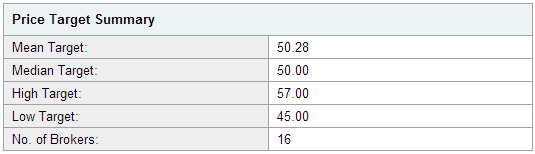

The Target Price Estimate Makes DAL a Must-Own Stock

Target price estimates polled by Thomson/First Call from 16 brokers covering DAL show attractive upside at the current price. The mean target price is $50.28 and presents an upward potential of 24% at the current price level of about $40.52.The median target price is $50 and presents an upward potential of 23% at the current price level. The most optimistic price estimate is $57and if materialized it presents an upside of 40%. The lowest target price estimate is $45 and presents an 11% upside. This is a very enticing valuation estimate where even the most pessimistic estimate presents an attractive upside at the current price. DAL’s stock is a must own for investors that are interested in gaining exposure in the growing airline industry.

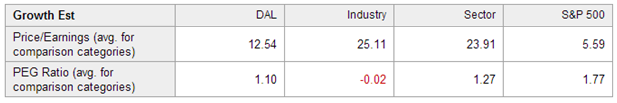

Relative Valuation Supports The Target Price Estimate

DAL’s P/E ratio stands at an attractive level of 12.54 times (shown in the figure below). The P/E ratio shows that the company is undervalued compared to the industry and the sector but overvalued compared to the average comparison category of the SP 500. Adding expected growth to the P/E analysis, the PEG ratio of 1.10 shows that DAL is undervalued compared to the comparison category of the sector and the SP 500. The price multiples reveal that DAL’s stock is relatively undervalued at its current price level and presents itself as a very attractive investment opportunity.

Conclusion

Delta is well positioned to capitalize on the growth in the air travel forecasted by economists. Emerging markets are expected to lead the growth and DAL’s global presence is expected to help it capitalize on the growth. DAL is aggressively working to bring operational efficiency to all aspects of its operations and this effort is translating into excellent financial performance. The consensus target price and relative valuation reveal that DAL is underappreciated by the market and presents itself as a very attractive upside at its current price.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.